when are property taxes due in illinois 2019

It is too early to determine the due dates for the 2021 real estate tax bills payable in 2022 but hopefully sometime in October and November will be the due dates. The last day to pay the Tax Year 2019 Second Installment before late-payment interest charges was Thursday October 1 2020.

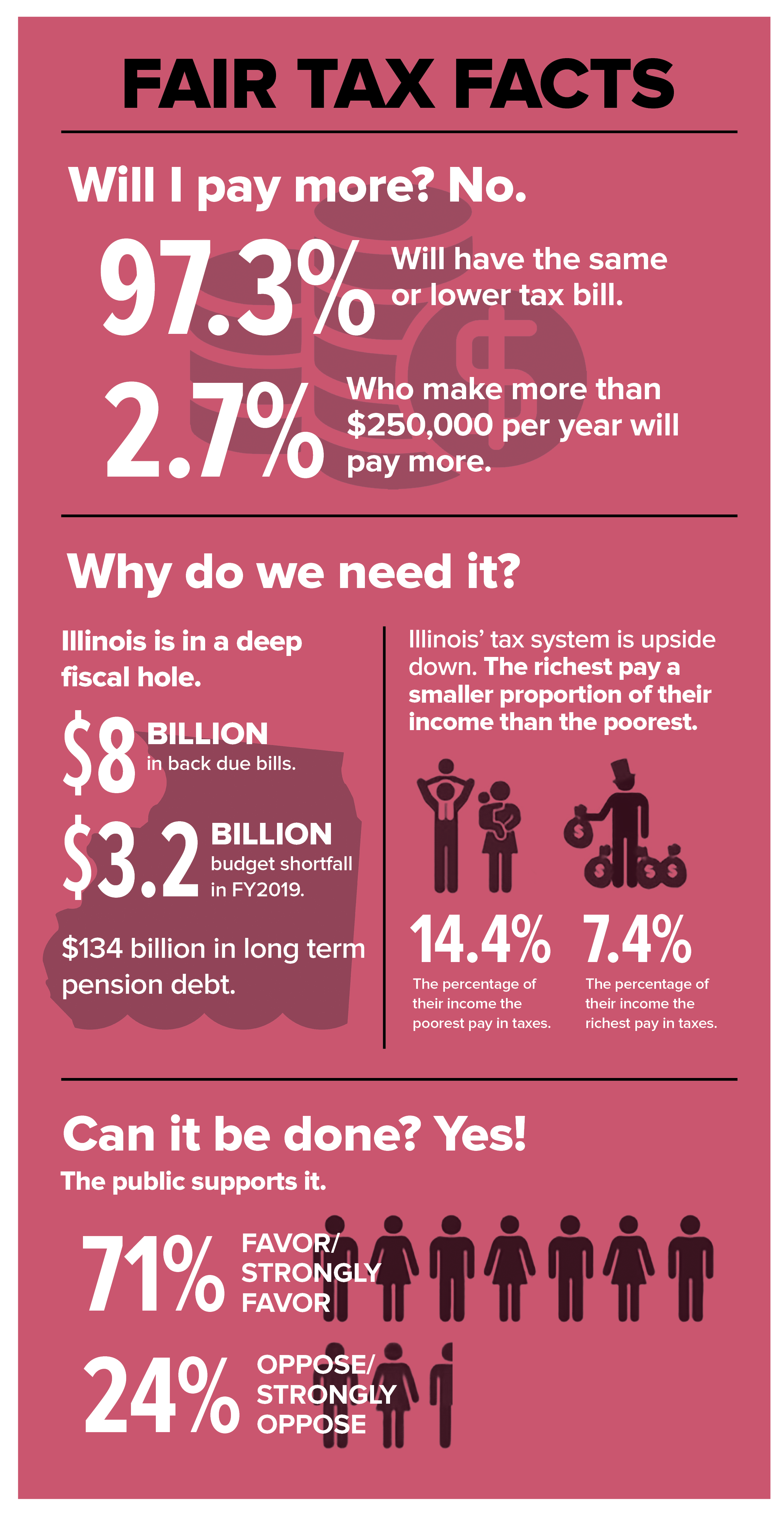

Progressive Income Tax Study Guide

The due date for the first installment of the property tax bill is coming up fast on june 3.

. 12 to give residents extra time to obtain unemployment stimulus checks or other relief. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Ad Free prior year federal preparation Prepare your 2019 state tax 1799.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. Property TaxesMonday - Friday 830 - 430.

Physical Address 18 N County Street Waukegan IL 60085. Property Tax First Installment Due Date. Property tax due dates for 2019 taxes payable in 2020.

Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale. When are property taxes due in illinois 2019 Sunday April 24 2022 Edit The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. For more information call us at 217 785-1356.

Billing and Collection of nearly 66 million real estate taxes. Tax amount varies by county. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

January 20 2020 - Dr. 15 interest on 2nd installment 6 interest on the 1st installment. Welcome to Ogle County IL.

There are several convenient ways to pay your real estate property taxes. Tuesday March 1 2022. January 1 2020 - New Years Day.

General Information and Resources. The due date for Tax Year 2019 Second Installment was Monday August 3 2020. Sangamon County committed to moving due dates on property taxes to June 12 and Sept.

Tax Year 2020 Second Installment Due Date. Property Tax Second Installment Due Date. Prepare your 2019 Illinois state return for 1799.

Mobile Home Due Date. Maps Records Transparency. Welcome to Ogle County IL.

To access this page you must be a local government official. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Conducts annual sale of delinquent real estate taxes.

173 of home value. In person weekdays from 830 AM 430 PM at the. Last day to pay at local banks.

Tax Year 2020 First Installment Due Date. Welcome to Madison County Illinois. Learn all about Illinois real estate tax.

Whether you are already a resident or just considering moving to Illinois to live or invest in real estate estimate local property tax rates and learn how real estate tax works. At one of many bank and credit union branches across Will County. The property tax due dates are April 30 and October 1 for the first and second half instalment respectively.

2021 Real Estate Tax Bills. Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. Due to this one-size.

Under illinois law areas under a disaster declaration can waive fees and change due dates on property taxes. Visit your countys official website or Department of Revenue and make an electronic payment to avoid queuing and waiting. Friday October 1 2021.

Tax Year 2021 First Installment Due Date. Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Local Officials Only Restricted Area - Here you will find local government forms and other information specifically for local government officials. 2nd installment due date. These general directives are made mandatory to secure objective property market value appraisals.

Election Night Results Contact Calendar Agendas Minutes Maps Employment. Free prior year federal preparation. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Montgomery County Courthouse Sign In Hillsboro Illinois Paul Chandler February 2019 Illinois Courthouse Montgomery County

Property Tax City Of Decatur Il

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

State Corporate Income Tax Rates And Brackets Tax Foundation

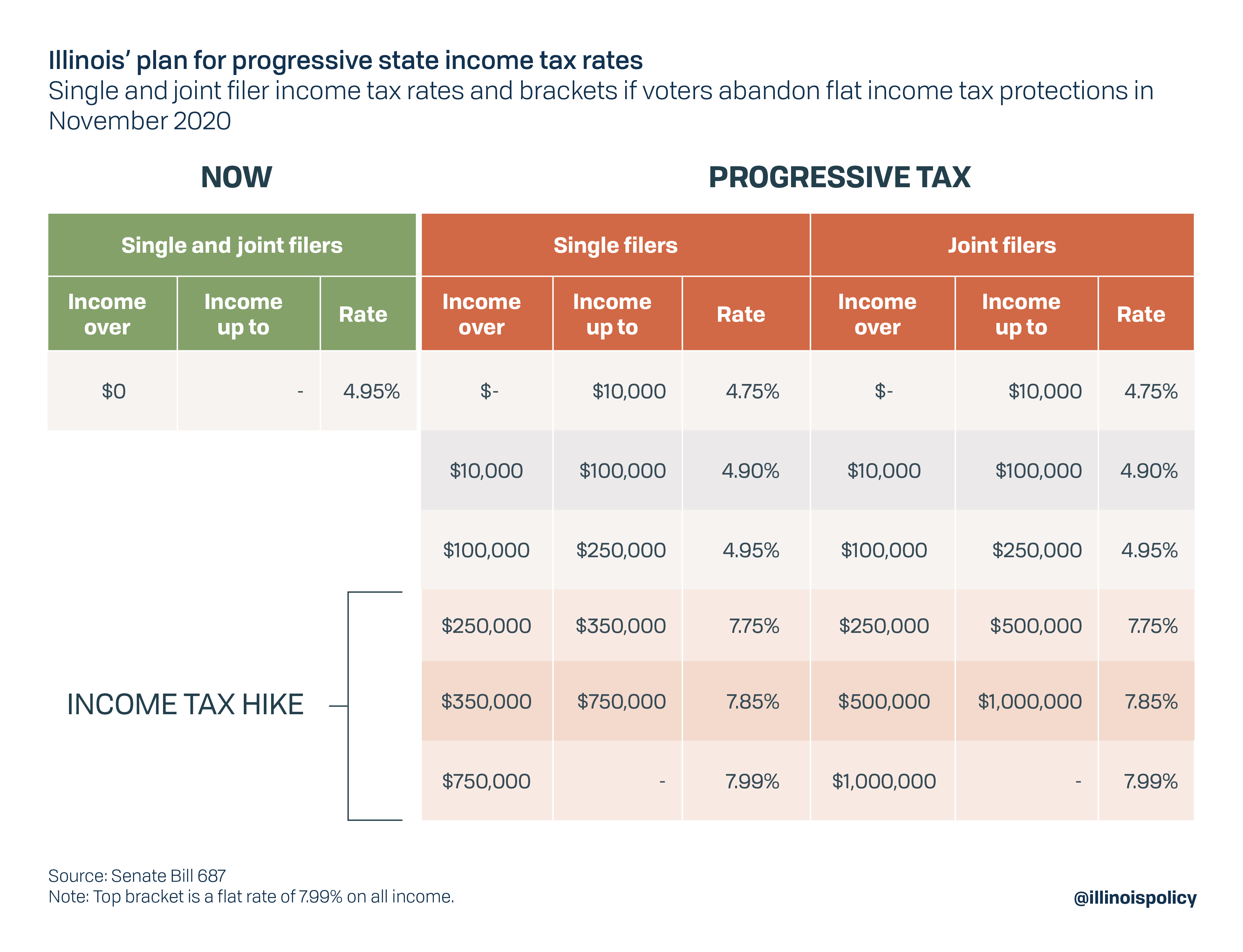

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Illinois Income Tax Rate And Brackets 2019

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

States With Highest And Lowest Sales Tax Rates

Normal We Must Entertain And More Entertaining Government Organisation Community College

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Illinois

State Corporate Income Tax Rates And Brackets Tax Foundation

Primera Ins Tax Services On Instagram Tis The Season For Tax Preperation Did You Know The Easies Financial Institutions Tax Software Best Tax Software

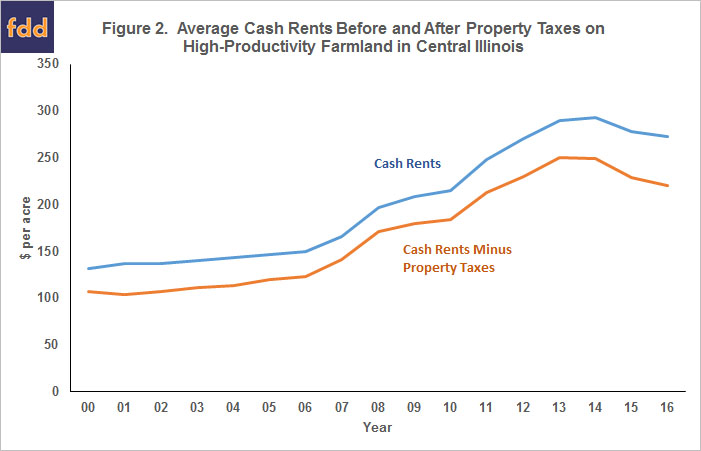

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily